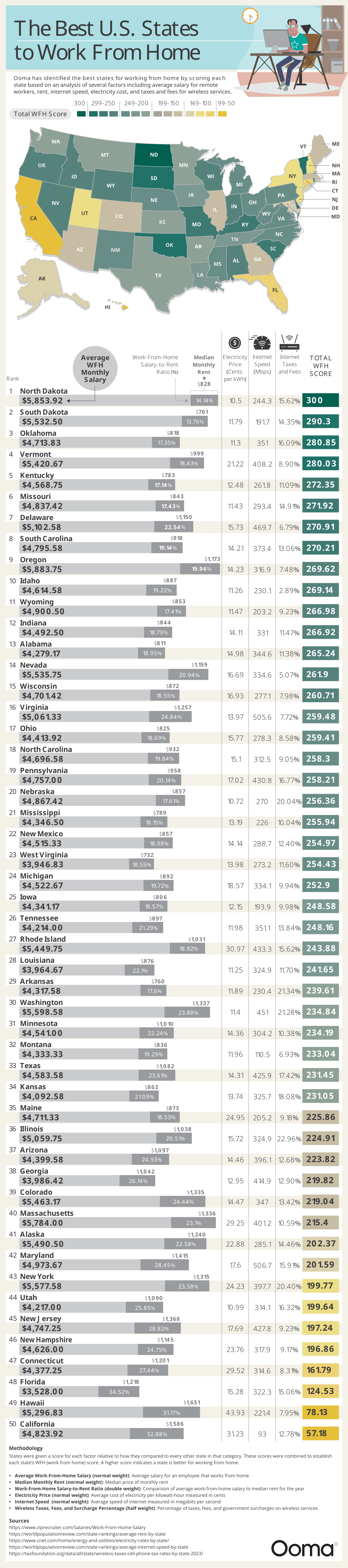

The best U.S. states to work from home

We’ve reached a new norm in America: 35 percent of workers who can work from home (WFH) are doing so full time, and 41 percent of them are on a hybrid schedule. Remote work is here to stay, with projections stating that more than one in five Americans will work remotely next year. But which state is the best for the “working from home” demographic in terms of taxes, salaries, rent and expenses? In other words, for those who work from home, where in the U.S. should that “home” be?

Embed code:

Best states for working from home

According to USA Today, the state with the highest percentage of remote workers is Colorado (at 21.2 percent). But with a median monthly rent of $1,335, does Colorado truly contain the best places to live for those working from home in the United States?

We would argue, based on data we’ve compiled, that the answer is no—North Dakota is the best work-from-home state, with high salaries, low rent, cheap utilities and acceptable internet speeds. The salary-to-rent ratio for North Dakotans is only 14 percent compared to 24 percent in Colorado, and that doesn’t even factor in the extreme expenses that can be found in cities like Denver.

These are the states that scored the best on our WFH index:

- North Dakota

- South Dakota

- Oklahoma

- Vermont

- Kentucky

- Missouri

- Delaware

- South Carolina

- Oregon

- Idaho

Worst states for working from home

The worst states for remote work have extremely poor salary-to-median rent ratios. California is notorious for its high rents, average salaries and very poor internet speeds—the worst of both worlds. New York and Connecticut can be problematic WFH states for a different reason, which we will get to.

All of these states have scored poorly on our WFH index:

- California

- Hawaii

- Florida

- Connecticut

- New Hampshire

- New Jersey

- Utah

- New York

- Maryland

- Alaska

Methodology for our working from home (WFH) index

States were given a score for each factor relative to how they compared to every other state in that category. These scores were combined to establish each state’s WFH score. A higher score indicates a state is better for working from home.

- Average WFH Monthly Salary1—This metric measures the salaries of the work-from-home demographic.

- Median monthly rent2—A statistic on the average rent by state is a great starting point.

- Salary-to-rent ratio—This ratio measures the comparison of the two above factors.

- Electricity utility prices3—Most home office expenses can’t be applied as a deduction, so it’s best to be aware of the costs of utilities you’ll likely be paying for out of pocket.

- Internet speeds4—Low-quality internet interrupts Zoom calls, Teams meetings, streaming webinars and many other kinds of work.

- Taxes and Government Charges on Wireless Services5—If you’re one of the many businesses who primarily run your business entirely through your mobile device, knowing about those extra service charges can be vitally important.

1 https://www.ziprecruiter.com/Salaries/Work-From-Home-Salary

2 https://worldpopulationreview.com/state-rankings/average-rent-by-state

3 https://www.cnet.com/home/energy-and-utilities/electricity-rates-by-state/

4 https://worldpopulationreview.com/state-rankings/average-internet-speed-by-state

5 https://taxfoundation.org/data/all/state/wireless-taxes-cell-phone-tax-rates-by-state-2023/

Other factors to consider

The double taxation issue

Note that there are some situations in which a remote worker might get “double taxed” for both the state you’re working in and the state you’re working out of. For example, if you’re working in Hawaii, but your employer has their main office in, for instance, New York, you’d have to pay taxes both for living and working in Hawaii as well as working out of New York. The five states in which the “convenience of the employer” tax rule applies are Connecticut, Delaware, Nebraska, New York and Pennsylvania.

In that case, beyond looking at the best state for remote workers, taxes out of your employer’s state must also be considered. Even though they might not rank as highly, it may be best to stay within, for example, Pennsylvania to avoid double taxation. Talk to an accountant to find the best solution for you.

Most states, on the other hand, have state reciprocity agreements for commuting workers. Obviously, remote workers will not need to worry about this in states that do not have an income tax, such as Nevada, Washington, South Dakota or Alaska.

Self-employment

Working from home for yourself is simply different than working from home for an employer. Montana has the largest percentage of self-employed workers by far. Many self-employed workers choose to live in places with low- or no-income tax, such as Alaska, Florida or our second-place state South Dakota.

City rent cost deviations

All our data represents work from home by state, rather than by specific city. Prices can escalate quickly in, for example, San Diego, Los Angeles, Bridgeport, Naples or San Jose, all of which are reported to have some of the highest median rents in the country. It’s important to consider your salary-to-rent ratio when planning any move.

Third places and food deserts

If you’re one of the many people asking, “I work remotely, so where should I live?” and then a friend tells you to go off “vibes,” it can feel extremely unhelpful. But some less-visible factors can have a big impact on your work-life balance. What is the point of working remotely if you need to, for instance, commute long distances to the grocery store? These so-called food deserts, where one cannot find healthy food options within a convenient commuting distance may negatively impact remote families unless parents are master meal preppers.

On the other hand, “third places,” or places that are not associated with work or home, are especially important for remote workers to avoid loneliness and burnout.

Internet service providers

Consistent and secure internet services are more important for some remote jobs than others, but almost all remote workers need fast phone and internet options. Sometimes, this means avoiding moving to an area that may include a functional (aka regional) monopoly.

Phone service providers

If you’re working from home and need to communicate over the phone often, you may want to consider a quality VoIP home phone service. Alternatively, if you’re running your own business from home, you may need to decide whether to consider a business phone system or another communication solution for you to be able to communicate with customers and employees seamlessly.

Our data

| Rank | State | Average WFH Salary | Average WFH Monthly Salary | Median Monthly Rent | Salary/Rent Ratio (%) | Electricity Price (cents per kWh) | Internet Speed (Mbps) | Taxes, Fees and Government Surcharges on Wireless Service (%) | TOTAL WFH SCORE |

|---|---|---|---|---|---|---|---|---|---|

| 1 | North Dakota | $70,247.00 | $5,853.92 | $828.00 | 14.14 | 10.5 | 244.3 | 15.62 | 300 |

| 2 | South Dakota | $66,390.00 | $5,532.50 | $761.00 | 13.76 | 11.79 | 191.7 | 14.35 | 290.3 |

| 3 | Oklahoma | $56,566.00 | $4,713.83 | $818.00 | 17.35 | 11.3 | 351 | 16.09 | 280.85 |

| 4 | Vermont | $65,048.00 | $5,420.67 | $999.00 | 18.43 | 21.22 | 408.2 | 8.9 | 280.03 |

| 5 | Kentucky | $54,825.00 | $4,568.75 | $783.00 | 17.14 | 12.48 | 261.8 | 11.09 | 272.35 |

| 6 | Missouri | $58,049.00 | $4,837.42 | $843.00 | 17.43 | 11.43 | 293.4 | 14.91 | 271.92 |

| 7 | Delaware | $61,231.00 | $5,102.58 | $1,150.00 | 22.54 | 15.73 | 469.7 | 6.79 | 270.91 |

| 8 | South Carolina | $57,547.00 | $4,795.58 | $918.00 | 19.14 | 14.21 | 373.4 | 13.06 | 270.21 |

| 9 | Oregon | $70,605.00 | $5,883.75 | $1,173.00 | 19.94 | 14.23 | 316.9 | 7.48 | 269.62 |

| 10 | Idaho | $55,375.00 | $4,614.58 | $887.00 | 19.22 | 11.26 | 230.1 | 2.89 | 269.14 |

| 11 | Wyoming | $58,806.00 | $4,900.50 | $853.00 | 17.41 | 11.47 | 203.2 | 9.23 | 266.98 |

| 12 | Indiana | $53,910.00 | $4,492.50 | $844.00 | 18.79 | 14.11 | 331 | 11.47 | 266.92 |

| 13 | Alabama | $51,350.00 | $4,279.17 | $811.00 | 18.95 | 14.98 | 344.6 | 11.38 | 265.24 |

| 14 | Nevada | $66,429.00 | $5,535.75 | $1,159.00 | 20.94 | 16.69 | 334.6 | 5.07 | 261.9 |

| 15 | Wisconsin | $56,417.00 | $4,701.42 | $872.00 | 18.55 | 16.93 | 277.1 | 7.98 | 260.71 |

| 16 | Virginia | $60,736.00 | $5,061.33 | $1,257.00 | 24.84 | 13.97 | 505.6 | 7.72 | 259.48 |

| 17 | Ohio | $52,967.00 | $4,413.92 | $825.00 | 18.69 | 15.77 | 278.3 | 8.58 | 259.41 |

| 18 | North Carolina | $56,359.00 | $4,696.58 | $932.00 | 19.84 | 15.1 | 312.5 | 9.05 | 258.3 |

| 19 | Pennsylvania | $57,084.00 | $4,757.00 | $958.00 | 20.14 | 17.02 | 430.8 | 16.77 | 258.21 |

| 20 | Nebraska | $58,409.00 | $4,867.42 | $857.00 | 17.61 | 10.72 | 270 | 20.04 | 256.36 |

| 21 | Mississippi | $52,158.00 | $4,346.50 | $789.00 | 18.15 | 13.19 | 226 | 10.04 | 255.94 |

| 22 | New Mexico | $54,184.00 | $4,515.33 | $857.00 | 18.98 | 14.14 | 288.7 | 12.4 | 254.97 |

| 23 | West Virginia | $47,362.00 | $3,946.83 | $732.00 | 18.55 | 13.98 | 273.2 | 11.6 | 254.43 |

| 24 | Michigan | $54,272.00 | $4,522.67 | $892.00 | 19.72 | 18.57 | 334.1 | 9.94 | 252.9 |

| 25 | Iowa | $52,094.00 | $4,341.17 | $806.00 | 18.57 | 12.15 | 193.9 | 9.98 | 248.58 |

| 26 | Tennessee | $50,568.00 | $4,214.00 | $897.00 | 21.29 | 11.98 | 351.1 | 13.84 | 248.16 |

| 27 | Rhode Island | $65,397.00 | $5,449.75 | $1,031.00 | 18.92 | 30.97 | 433.3 | 15.62 | 243.88 |

| 28 | Louisiana | $47,576.00 | $3,964.67 | $876.00 | 22.1 | 11.25 | 324.9 | 11.7 | 241.65 |

| 29 | Arkansas | $51,811.00 | $4,317.58 | $760.00 | 17.6 | 11.89 | 230.4 | 21.34 | 239.61 |

| 30 | Washington | $67,183.00 | $5,598.58 | $1,337.00 | 23.88 | 11.4 | 451 | 21.28 | 234.84 |

| 31 | Minnesota | $54,492.00 | $4,541.00 | $1,010.00 | 22.24 | 14.36 | 304.2 | 10.38 | 234.19 |

| 32 | Montana | $52,000.00 | $4,333.33 | $836.00 | 19.29 | 11.96 | 110.5 | 6.93 | 233.04 |

| 33 | Texas | $55,003.00 | $4,583.58 | $1,082.00 | 23.61 | 14.31 | 425.9 | 17.42 | 231.45 |

| 34 | Kansas | $49,111.00 | $4,092.58 | $863.00 | 21.09 | 13.74 | 325.7 | 18.08 | 231.05 |

| 35 | Maine | $56,536.00 | $4,711.33 | $873.00 | 18.53 | 24.95 | 205.2 | 9.18 | 225.86 |

| 36 | Illinois | $60,717.00 | $5,059.75 | $1,038.00 | 20.51 | 15.72 | 324.9 | 22.96 | 224.91 |

| 37 | Arizona | $52,795.00 | $4,399.58 | $1,097.00 | 24.93 | 14.46 | 396.1 | 12.68 | 223.82 |

| 38 | Georgia | $47,837.00 | $3,986.42 | $1,042.00 | 26.14 | 12.95 | 414.9 | 12.9 | 219.82 |

| 39 | Colorado | $65,558.00 | $5,463.17 | $1,335.00 | 24.44 | 14.47 | 347 | 13.42 | 219.04 |

| 40 | Massachusetts | $69,408.00 | $5,784.00 | $1,336.00 | 23.1 | 29.25 | 401.2 | 10.59 | 215.4 |

| 41 | Alaska | $65,886.00 | $5,490.50 | $1,240.00 | 22.58 | 22.88 | 285.1 | 14.46 | 202.37 |

| 42 | Maryland | $59,684.00 | $4,973.67 | $1,415.00 | 28.45 | 17.6 | 506.7 | 15.91 | 201.59 |

| 43 | New York | $66,931.00 | $5,577.58 | $1,315.00 | 23.58 | 24.23 | 397.7 | 20.4 | 199.77 |

| 44 | Utah | $50,604.00 | $4,217.00 | $1,090.00 | 25.85 | 10.99 | 314.1 | 16.32 | 199.64 |

| 45 | New Jersey | $56,967.00 | $4,747.25 | $1,368.00 | 28.82 | 17.69 | 427.8 | 9.23 | 197.24 |

| 46 | New Hampshire | $55,512.00 | $4,626.00 | $1,145.00 | 24.75 | 23.76 | 317.9 | 9.17 | 196.86 |

| 47 | Connecticut | $52,527.00 | $4,377.25 | $1,201.00 | 27.44 | 29.52 | 314.6 | 8.31 | 161.79 |

| 48 | Florida | $42,336.00 | $3,528.00 | $1,218.00 | 34.52 | 15.28 | 322.3 | 15.06 | 124.53 |

| 49 | Hawaii | $63,562.00 | $5,296.83 | $1,651.00 | 31.17 | 43.93 | 221.4 | 7.95 | 78.13 |

| 50 | California | $57,887.00 | $4,823.92 | $1,586.00 | 32.88 | 31.23 | 93 | 12.78 | 57.18 |